Overview of Exness – What does Exness Group do?

- Exness

- Exness Market Instruments

- Accounts Types

- How Register Account

- Exness Commission and Spreads

- Exness Leverage

- Deposit and Withdrawal

- Exness MetaTrader 4

- Exness MetaTrader 5

- Exness Terminal

- Exness Social Trading

- Market Analysis & Research Tools

- Education

- Exness Customer Support

- Conclusion about Exness

- FAQs

Choosing a forex broker is the most important part of any trader’s activity and therefore the first thing to do is to gather as much information as possible, all important data about the broker.

“What is Exness?”

This is just one of the few questions that you will get the answer to right now. So, here are a few facts you need to know:

- Exness has been providing a wide range of brokerage services since 2008

- The company is officially registered on the island of Grenadines and St. Vincent

- Exness Group provides its clients with all necessary facilities for successful trading on the Forex market, in particular with very high credit leverage and narrow spreads.

- All the necessary services of the company are already available on the digital portal www.exness.com.

- This brokerage firm is well known to customers trading in the financial markets and living in the CIS countries, developed and developing European countries, as well as in Asian countries

- The company is officially regulated (which means that clients’ interests are in the first place and always protected) and monitored by the CySEC regulator

- It is very simple to use the services of the company. Firstly, it can be done through the broker’s official website, as well as by contacting one of the many representative offices that are located around the world

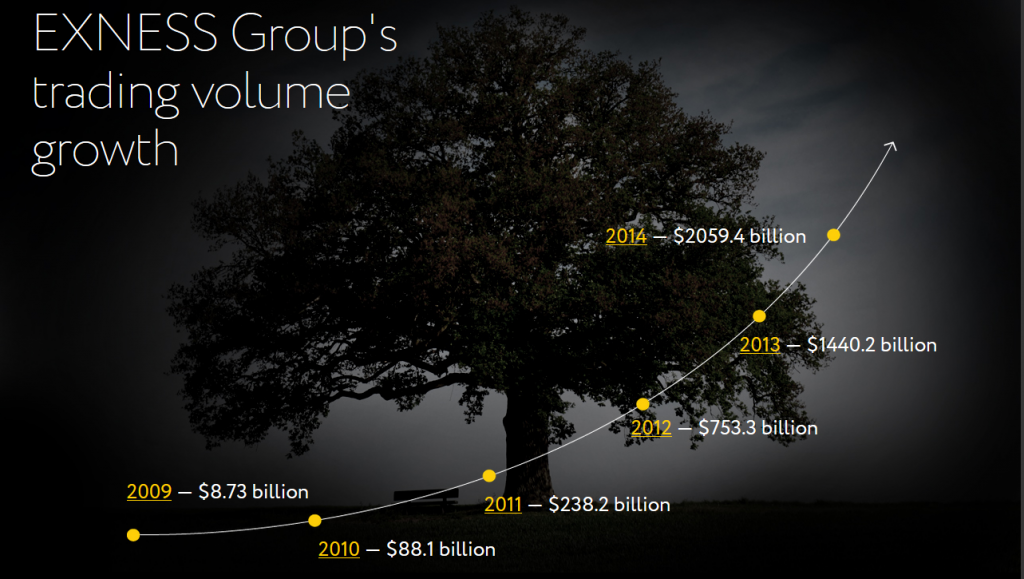

Established in 2008, Exness group is a successful broker that provides access to the forex market for more than 70,000 traders. In 2021, every network user who wants to earn money can connect the services of the company Exness. The company’s website provides access to top trading tools, has a well-thought-out structure and quality software. Monthly trading volume based on Exness has already exceeded 300 billion dollars.

How to start trading at Exness

Before creating an account on the Exness site, read the user agreement and risk warning. A trader should understand that broker Exness is not responsible for possible financial losses of the user.

Exness Group has been actively developing in the field of fintech since 2008. Over the past decade, it has grown into an industry leader —72,000+ clients of the broker trade for $325.8 billion every month. Exness Indonesia provides trading instruments for currencies, cryptocurrencies, metals, energy, equities and indices.

The broker’s clients speak and receive support in 13 languages from English, Chinese to Hindi and Bengali. The site is localized in 15 languages. You can trade with PC, iOS and Android mobile devices. For advanced accounts, a virtual trading server is available, which trades even when the client’s computer is turned off.

What is Exness? What do we know about Exness?

Lots of traders have long wanted access to trading in the financial markets.

They wanted to find better trading conditions. They have sought to trade cryptocurrency CFDs, precious metals, forex trades and other financial instruments, but they have not had that opportunity. Unfortunately, many firms ignore this region due to increased risks and other factors. Many, but not Exness Company.

Exness is the ticket that gives all traders without exception access to the financial markets, best trading conditions and the ability to trade all financial instruments.

Unlike many brokers who also provide opportunity to trade on financial markets, exness in addition to high-quality brokerage services also provides access to up-to-date market analytics as well as the latest research that allows traders to better navigate the market and make the right decisions. Large leverage gives the opportunity to earn even with minimal capital.

Exness Group and its activity are 100% transparent for all clients, which is proved by the financial auditor’s reports, in particular by such famous auditors as Deloitte.

Can exness be trusted and how reliable is it?

The company is audited by global financial auditors, one of which is Deloitte. This company is one of the top 4 largest auditors in the world. In addition, the company’s activity is also verified by other well-known auditors whose conclusions are more than clear: Exness Group can be trusted.

The cooperation of exness with external independent audit firms allows all clients to realize that this company is absolutely reliable and that it is always honest before its clients.

Is exness legal?

Exness is completely legal and legitimate to operate in multiple regions accross the world. Its operations are regulated and monitored by major financial regulators such as:

- Financial Services Authority (FSA)

- Cyprus Securities and Exchange Commission (CySEC)

- The Financial Conduct Authority (FCA)

- Financial sector conduct authority (FSCA)

- Central Bank of Curaçao and St. Maarten (CBCS)

- Financial Services Commission (FSC) – British Virgin Islands

Exness Company clients can not worry about the safety and honesty of the broker, because the firm’s activity is regulated by the FSCA in that region. And if up to this point you had any doubts about whether Exness is legal in multiple regions, now you can dispel these doubts and be fully confident in the legitimacy of the firm.

Exness Group Awards

In order to win awards, a brokerage company must provide high-quality trading services at the highest level and prove its exceptional reliability and impeccable reputation. Exness Forex has managed to do it. The company has received a huge number of different awards, the latest of which are:

- Most Transparent FX Broker 2019 (World Finance)

- Global FX Broker of the Year 2019 (The European)

Given the incredible rate of development of this firm, as well as other important factors, there is no doubt that these awards will not be the last. However, for the firm itself it is not awarded that matter, but client satisfaction with service quality and brokerage work. Awards are just another proof that exness company can be trusted.

Advantages and Disadvantages of Exness

Considering the wide list of provided services and the high quality of the service, future customers of exness company may ask: “Doesn’t this broker have any disadvantages?”. Of course, it does have some disadvantages.

Right now we will consider all the minuses and pluses of cooperation with exness company.

Advantages of Exness: |

Disadvantages: |

|---|---|

|

|

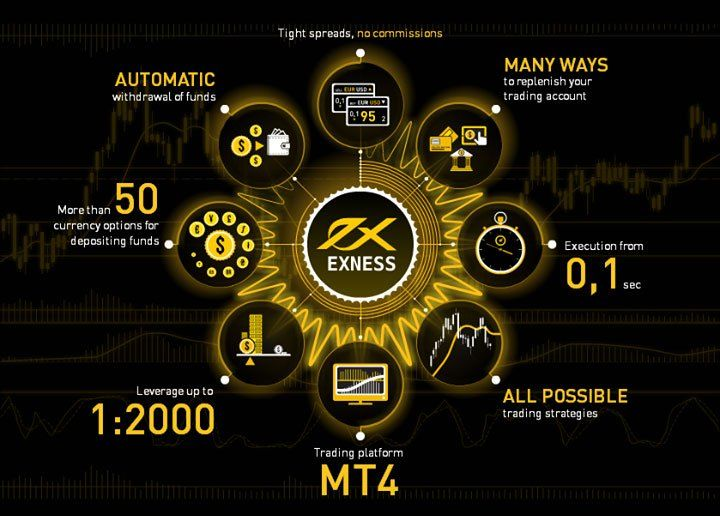

Tools & Services

Exness forex offers a variety of tools for trading. Customers can trade on MetaTrader 4 or 5, WebTerminal. At their service:

- Exness Trader App

- Currency Converter

- Calculators

- Virtual Server

- Market Analytics

- Economic Calendar

- Detailed Statistics with tick history

With the help of these services, clients successfully use prices, positions and liquidity of world markets.

Market instruments and products

In order to diversify your portfolio effectively, you need access to as many instruments as possible, and exness company allows you to do this. Each client receives the opportunity to trade stocks of leading companies, precious metals such as platinum, silver, palladium, and gold, a wide range of cryptocurrencies, the most popular currency pairs, commodities and energy sources, and of course indices.

Forex

Forex currency pairs are traded and exness broker didn’t ignore this market. All major forex currency pairs are already available for buying and selling and simple registration is all you need to access the vast opportunities of the forex market with exness group. You will be able to profit from both falling and rising currencies, and use the most popular strategies without any restrictions.

Forex trading is very popular instrument among traders, and exness also took it into account in its work. Right now, anyone can open an account and start trading.

Energy Resources

With exness broker, it’s easy to make quick and profitable trades in oil, gas, and other energy resources. Please note that this trading instrument is characterized by very high volatility, and therefore transactions in it should be made with caution and awareness.

First of all, the prices for energy resources are influenced by economic, environmental, and political factors. If there is a significant imbalance between supply and demand, weather conditions worsen dramatically, or situations that affect energy resources in one way or another, can either dramatically increase or decrease the value of assets. But despite this, trading these assets remains very popular with Exness Clients.

Precious metals

Gold is considered a safe haven for investors in times of uncertainty.

However, two important facts are worth noting:

- The demand for gold is increasing not only during the crisis but also at a time when the world economy is booming. This asset is always popular.

- Exness offers its clients the opportunity to trade not only gold but also a number of other precious metals, including palladium, platinum, silver, etc.

Cryptocurrencies

When reading your review about exness, you must have been looking for information about whether this broker provides the opportunity to trade cryptocurrencies, because they are really trending today. The answer to this question is positive. You can always buy and sell Bitcoin, Ethereum, Ripple, Litecoin, bitcoin cash, and other cryptocurrencies at Exness for a minimal fee. Read how to Trade Cryptocurrency.

Accounts and their types – Standart, Pro, Cent, Zero

Exness Broker Company offers its clients several trading account options, each of which has its own characteristics (margin requirements, commissions, leverage, etc.). All accounts offered by the broker can be divided into two categories – Standard and for Professionals.

You can find accounts for different trading styles in this company. If you are interested in opening a standard account, you can choose a regular account or cent accounts, in case you choose professional accounts you are given three options to choose from, namely Pro, Zero, and Raw Spread.

How do I register my account and which account type suits my needs?

In order to start trading with exness you will need to go through account registration. But first, you need to familiarize yourself with all the account types and figure out which one is right for you.

If you’re not ready to trade for real money, choose the exness demo account.

If you’re ready to start making money, make sure you have one of the following accounts and start trading:

- Exness Standard Account

This account is best suited for traders with some trading experience. It features low deposit requirements, fast execution of orders and the ability to trade all available assets, specifically 120 currency pairs and other instruments.

- Exness Cent Account

If you don’t want to take any risks, you can trade in lots of 0.01 cents. It is a great solution for those who just start their trading. It is a good choice for testing trading strategies.

- Exness Pro Account

It perfectly fits all trading styles and is the most popular choice of professionals. You can open as many orders as you want without any restrictions. Trade smaller volumes if needed. A low spread from 0.1 point is also an advantage.

- Zero Account by Exness

Trade 30 instruments with zero spread 95% of the time. An easy way to avoid requotes. The account is perfect if you use trading robots in your work. Also, depending on the selected trading instrument, your commission will be only 3.5 dollars per lot

- Exness Raw Spread Account

Get low spreads consistently, not occasionally. The commission per lot will be fixed, orders will be executed quickly and you will not have any limits on the number of open trades.

Commission Fees & Spreads

The commission a trader pays will directly depend on the type of account he/she has chosen. The final commission will depend on many factors

For example, if a client opens a Pro or Standard account, he will not have to pay any commission during trading, but at the same time, opening a Zero account, the commission will be equal to $3.5.

When opening a Raw account, you will need to pay a commission of up to 3.5 dollars.

You should also pay attention to the fees that are set for the citizens of individual countries. For example, if a client of the company lives in Vietnam and has a Standard account, the minimum deposit for such a client will be $15. For clients who do not reside in Vietnam, a similar deposit will be only $10. The situation changes when a client opens a Pro, Zero, or Raw account. For such clients, the minimum deposit amount will be $500.

Particular attention should also be paid to overnight and rollover fees. These fees must be paid if a client keeps a position open for more than one day. In each case, the client will need to pay one or another fee. In particular, the overnight fee may be charged as a standard fee or be provided as a refund.

As for withdrawal and top-up fees, exness broker does not charge any commission. However, such fees may be charged by payment providers and therefore exness clients should check with their providers prior to making withdrawals or deposits and inquire about any fees associated with such services.

Exness Broker Leverage

All beginning traders know how difficult it is to trade forex with insignificant capital. The standard trading lot is 100,000 units of the base currency. Most likely, profitable forex trading would still be a dream for many people, if it were not for the emergence of brokers, such as Exness, which provide their clients with leverage. Leverage provides an opportunity to make a good profit even with a little capital, which would not allow you to make good money without it.

However, some brokers impose serious restrictions on the use of leverage, while Exness broker does his best to keep these restrictions as small as possible.

Leverage is the loan funds a broker grants to his clients for transactions in the foreign exchange market.

If a trader has only $500 on his account and wants to make a deal of $10,000, he goes to a broker and uses 1:20 leverage. From that moment on, the exness client has an opportunity to make a deal that is 20 times higher than his real capital.

If a trade brings a profit, the trader returns to the broker the funds he borrowed and all the profit remains at his disposal.

Each brokerage company provides its own size of leverage. In the case of exness it is 1:2000. Exness company provides clients with a special calculator on which they can calculate the leverage available to them, depending on their available capital.

Please note that the amount of leverage decreases in proportion to the growth of equity available to the trader. An exness client with up to $999 can use any amount of leverage, while clients with larger amounts of $200,000 and up will be able to use leverage that does not exceed 1:100.

While many forex brokers motivate their clients to use as much leverage as possible, Exness doesn’t want you to lose money rapidly and warns clients that using leverage brings with it not only opportunities but also great risks. Experienced traders do not recommend the use of leverage greater than 1:5 and if the trader has no experience in trading the financial markets at all, it is better to practice on a demo account.

Deposit and Withdrawal – One of the strengths of Exness Global

When trading in the financial market, it’s important for retail traders to make a quick deposit into your account when you spot a great opportunity to make a trade. Exness brokerage company provides bonuses to its regular clients. After all, if you have any difficulty making a deposit and the funds arrive on your account only after a certain time, a good chance to enter the market may be missed.

The peculiarity of depositing with exness is their high speed, simplicity, and maximum convenience. The interface of the broker’s website is so simple that every client easily understands which section of the site to deposit and does everything in a matter of seconds. As for the choice of payment systems, exness also has no problems with this. You can choose from dozens of the most popular payment systems, which will be most convenient for you to deposit through. No matter whether it is a working day or a weekend, the deposit will be very fast and easy.

Payments systems

Broker Exness provides about a dozen convenient payment systems:

- Bank cards MasterCard and Visa of local and international banks

- Electronic systems Neteller, Skrill

The deposit is, in most cases, instantaneous, within a few seconds. Withdrawal can be instant, within a few hours or up to 5 days, depending on the selected funds. Money transactions can be made at any time of day.

Deposits and Exness Minimum Deposit

If you’re wondering how to make an Exness minimum deposit, you don’t have to worry about that, because once you sign up for your personal cabinet, all depositing options and the most popular payment systems are already available.

Also, by choosing one of the methods of funding, you’ll know how quickly the funds will be credited to your account and what commission you’ll have to pay.

The advantages of depositing with Exness are its high speed, which is especially appreciated by traders who make fast decisions on the Forex market. In addition, even if this is your first time making a deposit, there are no problems with it.

In order to deposit money into your account quickly and smoothly, follow some recommendations:

- Be sure to pay attention to the minimum deposit requirement when making a deposit using a single payment system. If you have a Professional account, the minimum deposit requirement is $200. If you have a Standard account, the minimum deposit amount will depend on the requirements and payment system.

- Make sure you are already verified. Only in case your documents were successfully reviewed, you can fund your trading account without any delays.

- Make sure that there are no discrepancies in the recipient data in the payment systems and the data you provided when registering with exness. Even a mistake in one character can be enough to solve your deposit problem later.

- Do not forget that withdrawals will be made in the same currency you deposited your account with.

You will be able to make a deposit 24 hours a day, both on weekdays and on weekends. Even though exness broker does not charge any deposit fees, be sure to pay attention to any fees that may be charged by payment systems.

How quickly the funds are deposited into your account will directly depend on the funding method you choose.

Withdrawals

Exness withdrawal is notable for its convenience and simplicity as well as for the opportunity to do everything fast and withdraw your funds on any day of the week, 24 hours a day.

All information about payment systems, through which you can withdraw your money, is already available in your personal cabinet. Here you can also find out what fee you’ll have to pay in case you choose one of the withdrawal methods as well as how quickly your withdrawal request will be processed.

Keep in mind some rules for withdrawing funds from your account when working with Exness:

- You can only withdraw money the way you made your account

- You will only be able to withdraw an amount that corresponds to the available margin in your account. Information about margin you can find in a personal cabinet.

- If several payment systems were used to fund your account, you will also be able to withdraw money through these payment systems, but in the same proportion as you deposited it

- Money is withdrawn from the account according to the priority of the payment system. With this fact in mind, in order to wait as little time as possible, first, use the withdrawal to your bank card, then you choose bitcoin and then any other methods.

In order to withdraw money from your account, go to “Withdrawal” in your personal cabinet.

Also, do not forget about the grace period. During this period, you will be able to withdraw money without any restrictions, but pay attention to one peculiarity.

The Exness Broker does not charge its clients a withdrawal fee. But before you withdraw money to one of the payment systems, be sure to find out what fees the system charges for such transactions.

The speed of transaction processing directly depends on the withdrawal method you choose. However, most electronic payment systems perform these operations instantly, literally within a few seconds. If the money is not deposited instantly, please contact exness support.

Exness is always adding new payment systems to make it even more convenient, faster and easier for customers to withdraw money from their accounts.

Trading Platforms that You Can Trade With in Exness

Many traders do not spend enough time choosing a trading platform and in vain. What trading platform you choose will directly affect the ease of dealing, as well as indicators, oscillators, and other tools for market analysis that you’ll get access to.

Exness Company offers its clients only the most reliable, multifunctional, and tested trading platforms, which have high level of convenience and provide access to the most required functionality for successful work on financial markets.

MetaTrader 4

Many clients choose Exness MT4, as this trading platform was considered one of the best and most feature-rich platforms for many years.

It provides access to all orders and timeframes traders require. The interface of this platform does not contain anything unnecessary that could distract traders from trading. It is very easy to use both when trading on a computer or using a tablet or smartphone. All data is displayed as correctly as possible. The trading terminal supports an extended security system based on a special encryption algorithm.

MetaTrader 5

Exness MT5 is preferred by traders who want access to more features than the fourth version of this popular trading platform.

In this version of the trading platform, users will find tools and features that are missing in MT4. The fourth version of the trading platform did not have customizable timeframes, as well as some types of orders that are available in the fifth version of the terminal.

Particularly available here are buy stop limit and sell stop limit orders, 21 configurable timeframes (there are only 9 in MT4), and other interesting features.

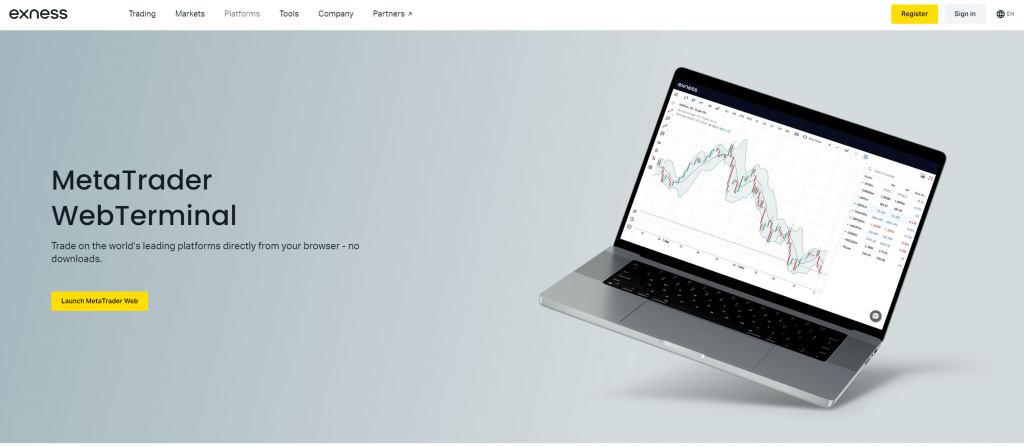

WebTerminal Exness

WebTerminal is very easy to use, because you can use it directly in your browser, without installing it on your computer.

Every user gets the functionality of the desktop versions of MT4 and MT5.

Some important features of Exness WebTerminal:

- Quick use. Just enter the trading account number by selecting the platform, for which the account was registered. Enter your username and password and start using it.

- By default you can use 20 trading instruments, which can be further expanded by following a few simple steps

- Ability to place both pending and market orders

- Availability of the “one-click trading” function allows you to open a new order with one click. To place other orders just drag and drop them onto a chart.

- Using this terminal is very easy and convenient to use online, which is why many Exness Customers really like it.

Exness Terminal

Exness Terminal was developed by Exness. It can only be used by clients of this broker who have opened MT5 accounts.

Some interesting changes are constantly being made to this trading terminal, which improves its functionality and provides access to the features that traders using other platforms do not have.

In order to access this terminal, just after registration, log in to your personal cabinet, click “Trade” and in the pop-up window choose Exness Terminal.

This terminal has some interesting features:

- The simplicity of account management is ensured by pop-up windows in the main menu.

- The presence of a chatbot based on artificial intelligence. This bot will help you to quickly find an answer to any question related to trading and terminal functions 24 hours a day

- It is possible to make trading as convenient as possible: set necessary indicators, save chart layouts, and so on.

- More than 100 indicators are already available.

- More than 50 drawing tools

- Fast access to information about your trading account

- Wide trading options: the ability to set order volume, set parameters for auto-close orders, initiate sell and buy orders with just one click and so on

Exness Social Trading

Many beginning traders are afraid of risks. It is understandable, nobody wants to lose all their money in just a couple of trades, but they lack the knowledge or confidence to trade at a profit.

Exness Group presents Social Trading. In order to earn from the first trades, it is enough to copy the trades of experienced traders and get the desired result. You will have the whole set of tools at your disposal, and you can control your investments quickly and efficiently.

You can manage your money as easily as if it were in your hands.

Using the social trading service, you can choose to watch the trading strategies, which were created and are used by professional traders. At the same time, all parameters of these strategies will be updated. For the use of such strategies, you will have to pay a commission of 0% to 50%.

Using a Social Trading account, one can get access to such instruments like cryptocurrencies, metals, and Forex. Such instruments as stocks, indices, and energy resources are not available for such trading.

By choosing social trading at exness company, you will be able to open a Standard and Pro account. In the first case, the minimum deposit will be $500, and for Pro $2,000. Spreads from 0.3 pips and from 0.1 pips for Standard and Pro respectively.

Market Analysis & Research Tools

A variety of tools and services for successful trading are available to all exness clients.

Let us have a look at some of them:

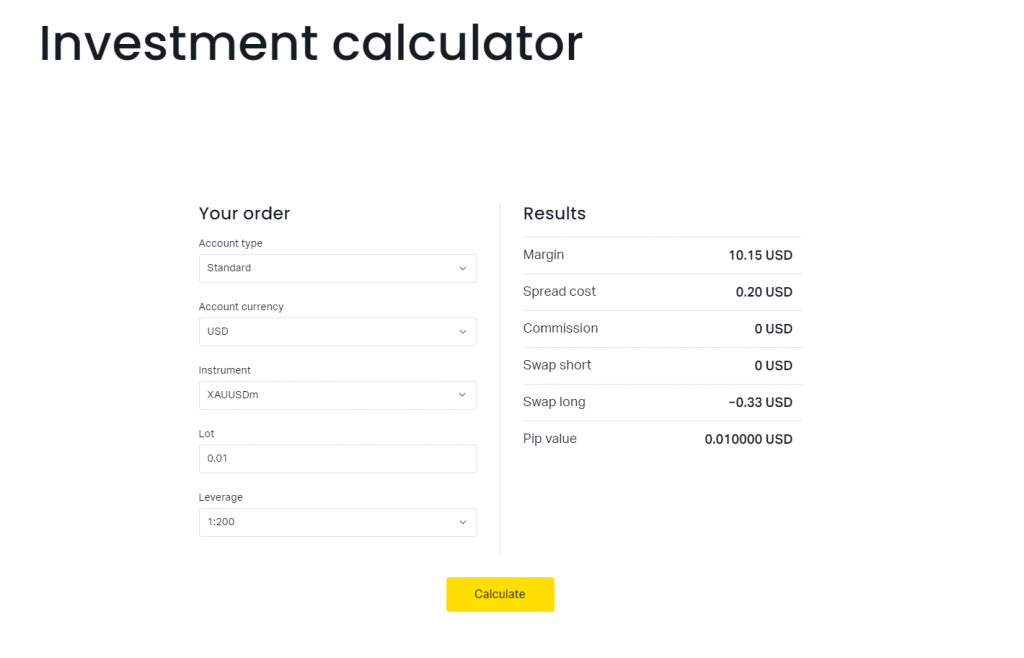

- Trader’s Calculator

While trading, a trader has to make a lot of calculations, but thanks to the convenient and simple calculator, you can quickly and easily calculate all the parameters of trading positions, such as pip value, swaps, margin, and so on. This calculator is especially useful for traders who hold several open positions in different instruments.

- Currency Converter

How do you quickly convert from one currency to another? You don’t have to search for the rate on various sites and calculate everything yourself, all you need is to use Exness handy currency converter. Thanks to real-time updates, our clients can be sure that they are receiving only the most up-to-date information.

- VPS Hosting

This service is provided free of charge. Exness Clients will be able to connect to a remote terminal and trade as if they were trading on a personal computer. In doing so, trading will be as safe and fast as possible due to the special trading environment. Now no power outages or other problems will bother you.

- Economic Calendar

It’s no secret that all trading instruments are influenced by economic events, such as decisions on key rates, publication of reports, and so on. It’s easy to forget about these events, but not with exness economic calendar. Now it will be even easier to keep track of all the important news.

- Web TV

Why look up important financial news from American sources when you can get the main video stream from the NYSE right now from Exness.

Education by Exness Company

A good broker will never leave his clients without important information and education.

All the important knowledge can be found at exness academy. 1000s of traders have already taken this course and gained all the knowledge they need to be successful in trading.

If you are just starting your way in trading, you will get all the basic knowledge you need and learn how to manage risk, and most importantly, how to put that knowledge into practice.

Experienced traders will also be able to take this training and remember important information they may have forgotten. By acquiring the knowledge, they will be able to keep themselves in the right frame of mind and increase the likelihood of making profitable trades.

Exness Online Training

Exness Online provides detailed training for beginner traders. In the Education section you will find:

- Academy

- Insights and analysis

- News

- Webinars

- Glossary

At the Academy, beginners learn the basics of trading, learn to manage risk, study other traders and improve their skills in practice. Here you can find text and video instructions on all aspects of the industry.

Insights section regularly publishes articles about world markets: gold and metal exchange rate forecasts, fundamental analysis of oil prices, technical analysis of cryptocurrencies pairs, and so on. Market news helps to make the right deals.

Webinars – is a new section where Exness publishes a schedule of future online seminars on Forex, risk management and other trading issues.

Easy registration will allow you to quickly start working with the markets. The motto of Exness – maximum comfort for clients!

Customer Support – a Good Relationship with Each Client

Exness broker provides support to its clients in different countries around the world.

Residents of South Africa, Portugal, Spain, France, Korea, Japan, Vietnam, Indonesia, and the Arab countries as well as the UK and China are supported in their native language.

In addition, answers to the most popular questions can always be found in the exness help center. If you cannot find an answer to your question, you will always find a chat form in the bottom right corner of your screen and you can talk to an operator.

Conclusion about Exness Group

Trading on financial markets is becoming more and more popular every day, so it is not surprising that many brokers are ready to offer their services to clients. However, not every broker has the necessary functionality and features for successful trading, providing their clients with all the necessary instruments. Other brokers may provide services and charge very high commissions.

Exness company stands out against other companies providing all traders with an opportunity to get access to the wide list of interesting instruments and for many of its services it does not even charge any fees. The company provides a service of social trading which is perfect for beginning traders and allows copying trades of professionals and earning from the very first attempts.

The company guarantees all traders exceptional safety, and its activity is checked by the largest auditing companies. In addition, exness takes care of its clients and provides round-the-clock support for all questions. If you are looking for a broker that you can trust and that delivers what you need, exness might be the right broker for you.

Frequently Asked Questions (FAQ)

What is Exness All About?

Exness is a brokerage company that has been offering its services since 2008. Scam broker? No! Many customers describe Exness as a company with an impeccable reputation and great access to opportunities to trade on the financial markets.

Is Exness Trustworthy?

Exness company is regulated by the largest auditing companies and international audit is conducted by the famous Deloitte firm. The numerous positive responses from the clients also show that this broker can be trusted.

Does Exness have Nasdaq?

Yes, exness allows its clients to access cfd on Nasdaq. This is done using the USTECm platform developed by the broker.

Is Exness Regulated?

Yes, the company provides its services to clients from multiple regions. Moreover, the company is among the top three brokers in that region. Moreover, the company is regulated by FSCA.

How does Exness Trading work?

The company offers ample opportunities and a secure trading environment to all its clients, regardless of their trading style. Some of them include low spreads, real-time trading platforms, fast deposit/withdrawal methods. Also, don’t forget about the educational platform.

Exness How to Trade?

To start trading, an investor needs to go through a simple registration and verify the account. Then, you need to make a deposit in a convenient way and do not forget to study the possibilities of trading platforms. After that, it will be possible to start trading.

Exness How to Deposit?

In order to deposit money into your Exness account, please, log in to your personal cabinet, go to “Deposit” section, choose the appropriate deposit method and the account to which you want to send money. Specify the deposit amount and the account currency. Click “Next” and confirm the payment.

What is the Minimum Deposit for Exness?

The minimum deposit to open an account is only $10.

Where is Exness Broker Located?

The headquarters of this brokerage firm are located in Limassol, Cyprus.

What is Exness Social Trading?

Social Trading provides the ability to start trading by simply copying the trades of expert traders for which you will be charged a commission. You can copy trades as well as share your strategies.

What is the Minimum Deposit for Exness?